Money laundering, a clandestine practice with far-reaching consequences, poses a significant threat to the global financial system. As a complex and illicit activity, it involves disguising the origins of illegally obtained funds to make them appear legitimate. This article aims to shed light on the intricate web of laundering, its methods, impacts, and the collective efforts undertaken to combat this global menace.

Table of Contents

Understanding Money Laundering:

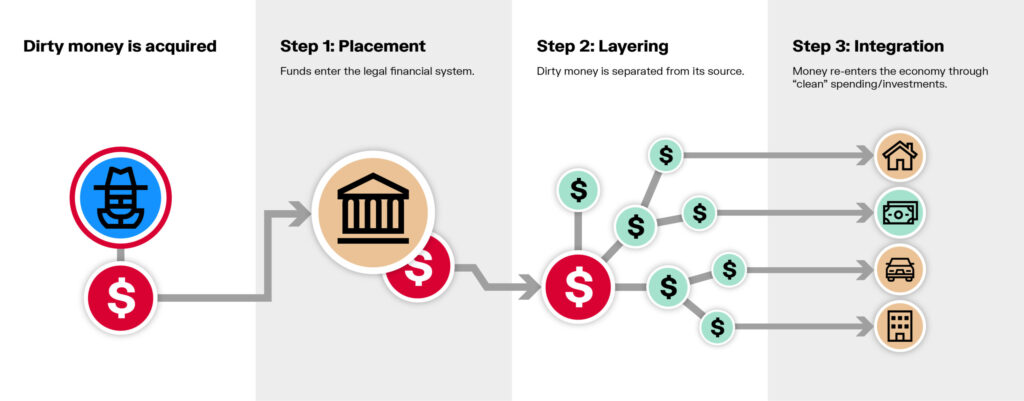

Money laundering is a three-stage process that typically involves placement, layering, and integration.

Placement: The illicit funds are introduced into the financial system. This can occur through methods such as depositing large sums of cash, purchasing valuable assets, or using the funds for gambling.

Layering: In this stage, the goal is to obscure the origin of the funds. Complex transactions and multiple transfers across different accounts and jurisdictions are common. This step aims to create confusion and make it challenging to trace the illicit funds back to their source.

Integration: The ‘cleaned’ funds are reintroduced into the legitimate economy. At this point, the money appears to be legal and can be freely used without arousing suspicion.

Methods Employed in Money Laundering:

Shell Companies: Criminals often establish shell companies with no legitimate business activities to serve as conduits for money-laundering. These entities can be used to disguise the true ownership of assets.

Cryptocurrencies: Digital currencies, like Bitcoin, have become increasingly popular for money-laundering due to their pseudonymous nature. Criminals exploit the decentralized and relatively anonymous nature of cryptocurrencies to move funds across borders.

Trade-Based Laundering: Criminals manipulate trade transactions by over or under-invoicing goods and services, allowing them to move money across borders without raising suspicion.

Real Estate Transactions: High-value assets such as real estate are attractive for money-launderers. Purchasing properties through complex structures makes it difficult to trace the true owner.

Global Impact

Undermining Financial Systems: Money laundering erodes the integrity of financial systems, compromising their stability and effectiveness. Illicit funds injected into the economy distort market dynamics and can lead to inflation or economic imbalances.

Funding Criminal Activities: Money laundering supports various criminal enterprises, including drug trafficking, terrorism, and corruption. The ability to legitimize illicit funds allows criminal organizations to expand their operations.

International Efforts to Combat Money Laundering:

Financial Action Task Force (FATF): An intergovernmental body, the FATF sets global standards for combating money-laundering and terrorist financing. It conducts evaluations of member countries’ anti-money-laundering measures.

KYC (Know Your Customer) Regulations: Financial institutions are required to implement stringent KYC procedures to verify the identity of their customers, making it more challenging for criminals to use the banking system for money-laundering.

Information Sharing and Cooperation: International cooperation among law enforcement agencies and financial institutions is crucial for identifying and tracking suspicious transactions across borders.

Conclusion

Money laundering remains a persistent global challenge that requires continuous vigilance and collaborative efforts. Governments, financial institutions, and regulatory bodies must work together to strengthen anti-money-laundering measures, enhance transparency, and stay ahead of the evolving tactics employed by criminal organizations. Only through a united front can the international community hope to effectively combat this pervasive threat to the integrity of the global financial system.

In a world driven by financial intricacies, understanding and confronting the realities of money laundering is not just a necessity but a shared responsibility. Together, we can cast a light into the shadows, exposing the clandestine operations that threaten the very essence of a transparent and fair global financial ecosystem. Governments, financial institutions, and individuals must remain vigilant, adapting to the ever-evolving tactics of those who seek to exploit the vulnerabilities in our financial systems.